Frequently Asked Questions

This accessible Digital Service is for everyone who wants to understand their financial picture – now and in the future. If you would like to take control of your finances, and make better financial decisions, then this service is definitely for you.

Step one – Our responsibility is to guide you through your financial journey. What that ultimately means is that you have a financial plan which accurately reflects your current situation, and incorporates your goals and ambitions for the future.

Your plan is in the form of a bespoke video, put together by your personal Lifetime coach highlighting the opportunities and challenges on the road ahead.

The process is an easy one and your coach is available to help answer any questions you may have.

Step two – Once you’ve received your tailor-made video, you will connect with your coach to review the opportunities and challenges the video has highlighted.

Should your plan highlight any area of your finances that needs further exploration – or urgently addressing – then we will arrange for you to meet with one of Lifetime’s financial specialists.

Step three – Accessing our specialists couldn’t be easier. Meetings are organised screen to screen, with no need to travel or prepare for a visit. Your specialist will want to get to know you and discuss the challenges and opportunities your plan has highlighted. In preparation, they will have fully reviewed your video and following the conversation will be able to build recommendations and advice based on your circumstances.

Why do we start with a plan? A plan ensures that we have a full picture of your current financial situation, aspirations and any concerns that may impact your financial journey.

This allows you to make informed decisions putting you in control of your future.

You will be allocated one of our dedicated Lifetime coaches at the time of registration. That coach will remain with you every step of the way as you fill in your information in the fact find, and will be available to answer any questions you may have.

Don’t worry, your financial planner will continue to give you the same great service that you are used to, whether you are on our CSD service or you have full annual reviews.

Time to fill in your details in the fact find will be dependant on how complicated your finances are, but should take no more than 25 minutes.

If you are confused about any of the questions or you cannot find some of the information we may need please ask your coach. Please note: the coach will not be able to give you any financial advice.

The coach is there to guide you through this digital journey and to create a video of your financial plan. If you decide to take further guidance this will require a financial planner who will be able to give you specific financial advice helping you to achieve your plans.

We aim to get the video to you within five working days of you completing the online fact find.

For your bespoke financial planning video, delivered by your dedicated customer coach, there is a fee of £149 including VAT. If you subsequently want a meeting with one of our financial planners, and receive a report of recommendations, there is also a fee of £149 (inclusive of VAT).

Lifetime’s Digital Service provides a financial picture which we would expect our existing clients to already have. Please contact your Lifetime financial planner if you have any questions about your existing plans.

You can access your PFP by going to the top of the new website, at the far left, and clicking on the Personal Finance Portal tab.

Please do! If you believe we have been of benefit to you in your own financial planning then please pass on the news that we have a digital service available.

We are passionate about helping people make the correct financial decisions based on their circumstances and wishes, and giving them the means to review and update as required.

Whatever stage of life you are at, from starting to save, buying your first property, through to considering your retirement options, we are here to offer a guiding hand.

Our digital service offers people the opportunity to take control of their finances – and make better informed money choices.

We are endeavouring to bridge the advice gap by providing all generations with easy and secure access to full financial planning, together with a great digital experience.

If you are struggling to log back in to access your video, for whatever reason, then please contact your coach and they will be happy to help.

We have invested in an online portal which gives our customers bank style security with their information. We do not share your information with third parties without your permission.

Financial planning is an ongoing process that helps you make sensible decisions about money, so that you achieve your goals in life.

It is about getting organised. It is far better to be in control of your finances rather than letting those finances control you. Many people find their finances confusing, aren’t sure where they are headed, or would like a little more guidance on how to manage their money. They wonder when they can retire, how their family would cope if they were unable to work, or whether they can afford to make their aims for the future come to life.

Only by having a purpose-built, fluid plan in place will you be able to know and understand your current financial position, have the necessary signposts in place to chart your way, and take the necessary steps to attain your goal. In other words, a sound financial plan is a road map to your objectives.

People with a financial plan are much more likely to realise their goals and objectives – indeed all that you wish to do and achieve in the future.

Your finances determine a lot of your choices in life. Fully understanding your financial picture helps focus the mind on the tasks required to achieve those objectives, plans and dreams – and to identify obstacles, if any, that need to be overcome.

Cashflow modelling helps people find out what their finances look like and whether they will have enough money in the future. It can help with all kinds of different goals and answer questions such as:

- Will I have enough money to stop working when I want to?

- Am I going to run out of money in later life or can I spend more now?

- Will my family be financially secure if I go into care or die unexpectedly?

- Am I going to leave behind an Inheritance Tax bill?

- Can I afford to give away money in my lifetime?

- How can my other savings, such as ISAs, contribute to my overall retirement income?

- How can I take an income in the most tax-efficient way possible?

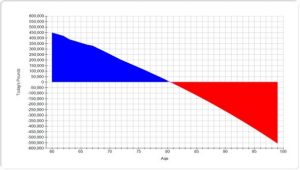

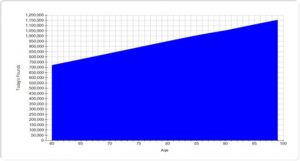

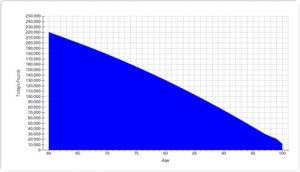

Here are some examples of cashflow modelling outcomes:

1: Typical cashflow results: Spending too much; not enough income; money not working hard enough.

2: Not spending enough; being too frugal; not enjoying life to the full; paying unnecessary tax on death.

3: A great plan: spending what you want when you want to, keeping enough for care costs in old age and dying at the end of a happy and fulfilled life with no tax to pay.

A financial bucket is a visual concept we use to help our clients understand their money.

Your financial bucket has in it all of the money you could easily get your hands on. By understanding what’s in there, and how your money flows in and out, now and in the future, you can take control of your financial life.

Your bucket won’t just let you take control either. It will also help you to answer some of the biggest questions in your life. When can you retire? Can you afford to help your kids out with their first step on the housing ladder? Can you afford to spend more on doing the things you love?

Here is a short video explaining what a financial bucket is all about:

The responsibility of managing your finances, and that of your family, has never been more onerous than at this present time.

In years gone by the majority of companies offered pension schemes that were fully managed by Trustees. If you were a member of one of those schemes then you had virtually no decisions to make. These days many people are members of different types of schemes that require decisions to be made and choices to be understood.

It is Lifetime’s opinion that few members are qualified to make the correct decisions and need help and guidance. The pension world has become a very complex place and we are here to help you make the right decisions, by getting you to fully understand your financial position.

Recent pension and tax legislation has given the public much more flexibility and choice. But that brings with it so much responsibility! At the time you are about to make key decisions do you fully understand all that legislation, the various options and the in-depth tax detail required to make the right choice for you and your circumstances?

Another area where we firmly believe people need professional guidance is around investment choice.

Individuals are now finding themselves responsible for investment decisions on significant amounts of money, across different savings’ pots. We come across people who have values in pensions that are noticeably higher than their property values; they also have ISAs and other savings.

We don’t believe individuals should be making decisions on where this money is invested without proper guidance. We believe the way forward is to first establish a financial plan that has considered all aspects of your current financial position. Without the proper modelling software this is very difficult to do! Once this is created it gives you the insight to make the right choices.

You will be asked relatively straight-forward questions, such as what you own, what you owe, and what you earn. In conversations with your customer coach, he or she will also help you assess your goals and objectives, and consider your experience, attitude and your core values.

You will need to be thoughtful and candid, as we look at:

- What is your situation around income and outgoings, both now and in the future?

- What about family and dependants?

- What assets and liabilities do you have and what tax position are they in?

- What about all your lifelong pension arrangements?

People often seek financial advice because of a specific issue, such as a concern over a pension policy, but right at the heart of that need is one overriding thing: peace of mind. You want to make sure that you can live how you want without ever running out of money. It is an important goal and what cash flow financial modelling is all about.

The benefits:

- Clarity and understanding!

- To get to the position where you thoroughly understand your current financial position and the decisions you are about to make.

- Peace of mind that at last the complex puzzle of your finances has been resolved in a professional, accurate and understandable way.

- You can now get on with your life, realising the plans you have been making.

- Having the knowledge and reassurance that you can revisit the road map to your finances at a future date.

- To know that you will always be in that fully informed position.

We are a long established business that is passionate about helping people make the correct financial decisions based on their circumstances and wishes, and giving you the means to review and update as required.

We have vast experience in delivering this to thousands of couples and individuals over the years.

Along with our expert financial planners we have a specialist, highly qualified pensions department, who are dedicated to technical pension research and analysis. Backed up by our dedicated team of customer coaches and support staff, they can give you the correct answers and understanding via sophisticated modelling software.

We listen to understand – and make the complicated simple.

Integrity, openness and honesty are part of our DNA.

In short – yes! One of the main benefits is that, when you pay into a workplace pension or a personal pension, you can get money back from the government in the form of tax relief.

It is a way of encouraging you to prepare for your retirement and it effectively amounts to free money, so it is best to make the most of it.

The ideal scenario would be to obviously have both if possible and your budget permits. However, while both pensions and ISA are good vehicles for saving, the full picture must be considered to work out what’s best for your circumstances.

Both saving vehicles have a lot of positives and choosing just one could depend on what you are trying to achieve. If you are saving for retirement then undoubtedly a pension is the better option due to the tax breaks.

However, an ISA may be better if you are saving for a medium term goal and or want to access your money sooner than retirement age. In this scenario an ISA would be a good solution that is also tax efficient.

You or your employer can usually pay up to £40,000 every year in to your pension, but there are limits to how much tax relief you can receive.

As highlighted above, a pension is a tax efficient savings scheme. You receive tax relief on your contributions as you pay in to your pension and your savings have the possibility of growing with minimal tax.

The actual amount you can pay in a tax year for tax relief purposes is the greater of:

- A gross contribution of £3,600 or:

- 100% of your earnings, subject to the annual allowance.

The current annual allowance for most people is at £40,000.

We’ve seen how payments into pensions can get tax relief, but what about money coming out?

Any retirement income over your personal allowance is taxed, just like your wages are when you work. The personal allowance is currently £12,500 but this could change in the future.

However, pension freedoms introduced in 2015 mean people now have much more control over how to manage their pension savings than ever before, and you can take up to 25% of your pot as a tax-free lump sum which you can access from the point you reach the minimum retirement age (currently 55).

You now have more choice and flexibility than ever before over how and when you can take money from your defined contribution/personal pension pot. Here are some of the available methods.

- Leave your whole pot untouched

- Guaranteed income (annuity)

- Adjustable income

- Take cash in chunks

- Take your whole pot in one go

- Mix your options

We believe each route requires careful consideration and advice where possible as what you decide now will affect your retirement income for the rest of your life.

A great benefit of pension plans is that you can usually start taking money from them from the age of 55. This is well before you can receive your State Pension.

Whether you have a defined benefit or defined contribution pension plan, you can usually start taking money from the age of 55. You could use this to help top up your salary if you are still working, to enable you to work fewer hours or to retire early. You may also be able to release a cash sum from your pension too.

There are also some circumstances when you may be able to take money from your pension even earlier than 55, such as if you’re in poor health.

Whether you are buying your first home or moving up the housing ladder the time when you need a mortgage can be exciting. However, choosing that mortgage can be daunting! Our team of mortgage brokers can help you to find the right deal.

We can help you with:

Your first mortgage as a first time buyer

A mortgage for your house move

Your buy-to-let property

Product transfers

We will take the time to explain all of the different options to you to make sure you that you are with the right provider and have the right mortgage product.

If you are moving into a new home you’ll already have more than enough on your plate, but even if you just need help with a re-mortgage or product transfer we understand that you have a busy life. We can take the burden of dealing with mortgage lenders off your shoulders.

Our qualified mortgage advisers and experienced administration team can save you time by making sure that your application is organised and has all the important details first time.

Because we have many years of experience dealing with different lenders we know who can help you if you have complicated circumstances. We deal with a full range of lenders from across the country.

We are here to offer help and advice to our clients, and we don’t believe in stopping as soon as your mortgage has been offered. After you have received your offer we will still be here to help you with questions about your mortgage.

We will always be on your side. If you want unbiased, expert advice and friendly service please get in touch!