Investment Risk is carried on all types of investment related retirement plans. These plans range from: With Profit plans, Flexible Investment Linked Annuities, and Drawdown Plans.

All offer different features for taking income, but all carry investment risk.

A benefit of these plans is that they allow people at set review dates to adjust their income in-line with their spending habits through retirement.

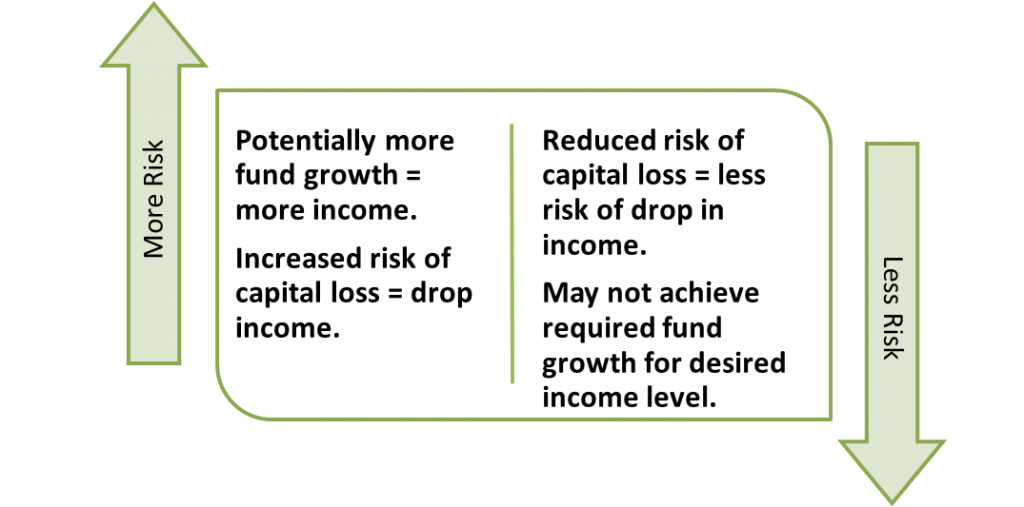

However, this flexibility comes at a risk, termed Investment Risk. This is because your Pension Fund remains invested. This means any potential growth could be used to achieve a higher income if need be, but any fall in fund performance could lead to a reduction in income.

This means stripping out income in the early years could potentially leave you severely tightening the purse strings if the fund performance falls.

At the time of writing, some of these investment related retirement plans offer ‘guarantees’ and ‘growth lock-in’ features to help guard against investment risk and the potential reduction of income – but these features come at a cost.